Our new member Laplace presents its advice on the topic: "Expatriation: optimizing wealth management"

A Family office approach in Wealth management and social protection with an international vision.

Laplace is a Crystal Group firm, leader in wealth planning.

For 35 years, we have been assisting our international clientele, mostly French or French-speaking, in providing wealth management solutions in France and internationally.

We advise over 50,000 clients in 15 countries to help them create, develop, and transfer their wealth, providing solutions on civil, tax, inheritance, and social protection matters.

Our work does not stop there; we also specialize in investment consulting and management, offering a range of tailored solutions allowing our clients to access all asset classes: direct and indirect real estate, life insurance, private equity, financial products...

We are an historic Partner with CCi FI et with CCi norway for this year, with the objective of providing our expertise to a French-speaking clientele established in Norway, but also to advise Norwegian clients investing in France on the management of their assets, optimization of ownership structures and taxation.

Expatriation: optimizing wealth management

Expatriation is a complex project that raises numerous questions regarding social protection, income tax, the functioning of the matrimonial regime, and applicable inheritance rules.

Questions about retirement and the management of assets that will generate additional income for the future are also central themes in the wealth strategies of many business leaders or senior executives.

The finding is undeniable: it is impossible to find a single interlocutor with expertise in all these areas, especially internationally, and capable of addressing both professional and private matters.

Laplace is a French brand dedicated to supporting its French and international clients through its unique expertise to address all these issues by mobilizing internal multidisciplinary skills and integrating specific competencies through partners such as lawyers, notaries, and accountants (who can be the client’s advisors if they already have an existing advisory environment).

This role of General Secretary of the client's patrimonial interests allows us to coordinate the different issues, prioritize them, and co-construct a personalized wealth planning strategy with the participation of the client and their advisors.

In the case of French expatriates in Norway, the link with France often remains strong, as they continue to create and develop wealth in France.

This connection with the country of origin has several implications, starting with generating certain tax obligations even when the tax residence is in Norway.

We distinguish three specific cases:

- Ownership of real estate assets in France

- Ownership of financial assets in France

- Ownership of assets through a company in France

Take, for example, the ownership of real estate assets; if these properties are located in France, the tax is due in the country where the properties are situated. Renting out unfurnished or furnished properties will be significant from a tax perspective. It should also be noted that the Real Estate Wealth Tax applies if the net value of the properties exceeds €1,300,000.

It is interesting to note that holding real estate assets within a company can, on a case-by-case basis, offer more favorable tax treatment than direct ownership, thanks to the corporate tax mechanism set at a flat rate of 15% on profits up to €42,500.

Another example of this ongoing connection between expatriates and their country of origin is the place of residence of children. After living abroad with their parents, it is not uncommon for children to decide to return to their home country or pursue their studies elsewhere.

This can significantly impact wealth transfer strategies during one's lifetime, as when making donations to children by French residents in Norway, France will assess the situation as follows:

- If the beneficiary of the donation is a resident outside of France: only the assets located in France that are the subject of the donation will be taxable in France.

- If the beneficiary is a resident in France (at least 6 years out of the last 10 years): the entire donation received will be taxable in France.

Understanding one's fiscal, inheritance, and retirement environment will help facilitate decision-making.

The mode of asset ownership will have a direct impact on the applicable tax (company or direct ownership), as well as the type of assets themselves (no tax on bond coupons, but possible tax on stock dividends depending on the country of residence). Strategic decisions such as making donations to children to reduce the taxable base or deciding whether or not to contribute to the CFE to enhance one's French retirement should be considered as part of a comprehensive approach to international wealth management.

These strategic issues also directly concern Norwegians residing in France or holding assets in France, who need to be assisted in optimizing the mode of ownership of their wealth, the taxation of French-sourced income, and the reporting aspects.

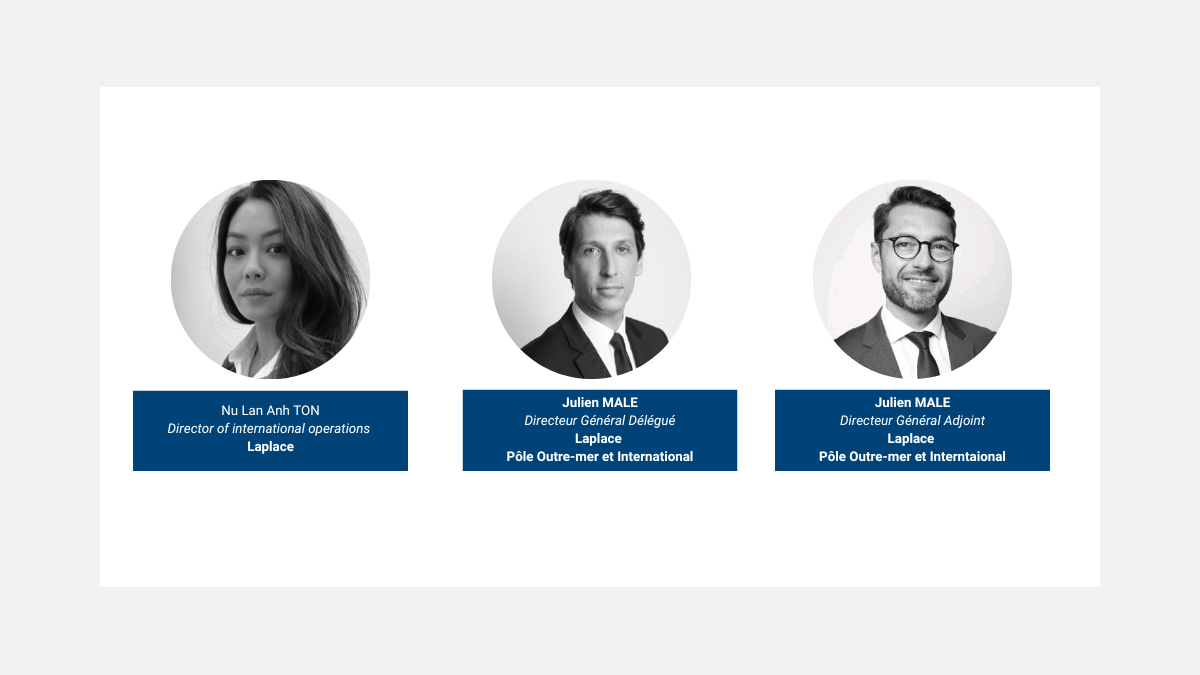

Laplace's expert teams, based in France and internationally, can help you address your various wealth management issues. Do not hesitate to contact us directly via the following link: Laplace